About Us

Who We Are

Savefin Insurance Brokers Pvt Ltd (SFIB) is a specialist broking company, offering a wide range of insurance products and services. SFIB is licensed by IRDAI to operate as a direct general insurance broker in India.

The essence of the Insurance business centres around trust, which SFIB enjoys by ensuring the best ethical practice. SFIB understands the dynamics of the Indian market and provides the best suited insurance solutions to its clients.

SFIB is committed to serving both individual and corporate requirements and is proactive and creative in producing insurance solutions suitable to individual and corporate risks, typically faced in the Indian marketplace.

SFIB through empanelment / tie-ups with various general insurance companies offer single window services & support for many policies available in the market.

What We Offer

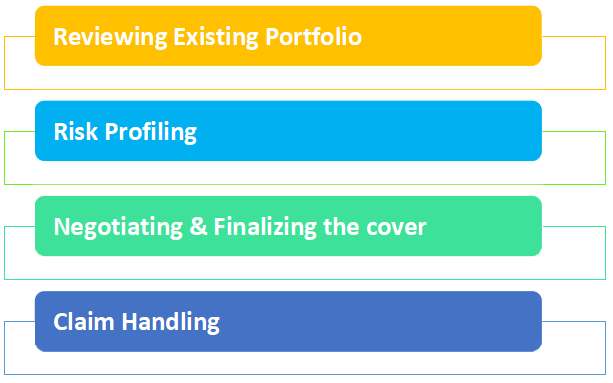

Savefin Insurance Brokers stands out as a total risk solution provider, delivering all risk management service standing from risk priority to claims handling.

Areas of Service

Through our empanelment / tie-up with various general insurance companies, we offer single window services & support for many policies available in the market:

1. Fire Insurance

Fire insurance is a type of property coverage that pays for damages and other losses that you may suffer from a fire. It covers the cost of repairing or replacing damaged property in your home, office, factory or other dwellings. The coverage, claim and exclusion under Fire insurance varies depending on the type of fire policy.is a type of property insurance that covers losses or damage to a structure or personal possessions caused by a fire.

2. Marine Insurance

Marine insurance covers the physical loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance is the sub-branch of marine insurance, though marine insurance also includes onshore and offshore exposed property, (container terminals, ports, oil platforms, pipelines), hull, marine casualty, and marine liability.

3. Motor Insurance

Motor insurance (also known as car insurance, vehicle insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Motor insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects.

4. Health Insurance

Health insurance or medical insurance is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement.

5. Liability Insurance

Liability insurance (also called third-party insurance) is a part of the general insurance system of risk financing to protect the purchaser (the "insured") from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy. Originally, individual companies that faced a common peril formed a group and created a self-help fund out of which to pay compensation should any member incur loss (in other words, a mutual insurance arrangement). The modern system relies on dedicated carriers, usually for-profit, to offer protection against specified perils in consideration of a premium.

6. Engineering Insurance

Engineering insurance refers to the insurance that provides economic safeguard to the risks faced by the ongoing construction project, installation project, and machines and equipment in project operation. Product categories: Depending on the project, it can be divided into construction project all risks insurance and installation project all risks insurance; depending on the attribute of the object, it can be divided into project all risks insurance, and machinery breakdown insurance.

7. Miscellaneous Insurance

Miscellaneous Insurance refers to contracts of insurance other than those of Health, Fire, Marine, Motor, Liability Engineering and Cyber Security insurance. Some examples of miscellaneous insurance are aviation hullinsurance, burglary insurance, cattle insurance, travel insurance, household insuranceand miscellaneous expenses insurance. Miscellaneous insurance can protect against damage, destruction, theft, accidents, loss of income, loss of value, and other financial losses.